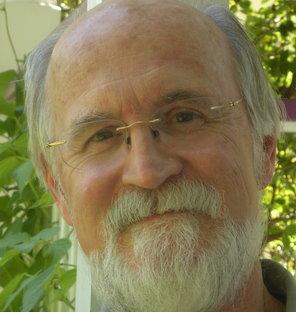

Interview of John Emmeus Davis, Cofounder of Burlington Associates in Community

Development and Dean of the National CLT Academy

Interviewed by Steve Dubb, Research Director, The Democracy Collaborative

April 2011

John Emmeus Davis has been involved in the development of community land trusts since the early 1980s. He was one of the founding partners in Burlington Associates in Community Development in 1993, a consulting cooperative providing assistance to nonprofit organizations and municipal governments in designing and evaluating policies, programs, and projects promoting permanently affordable housing. He previously served as the housing director and Enterprise Community coordinator for the City of Burlington, Vermont. He has also worked as a community organizer and nonprofit executive director in the Appalachian region of East Tennessee. He is on the faculty and board of the National CLT Academy and currently serves as the Academy’s dean. He is the author of many books, articles, and training manuals focused on community land trusts and other forms of resale-restricted, owner-occupied housing (most recently, editing The Community Land Trust Reader, published in 2010 by the Lincoln Institute of Land Policy).

How did you become involved with community land trusts (CLTs)?

I was a graduate student at Cornell. My studies were focused on community development and city and regional planning. I had come to graduate school as an older student. I had been out of school for six years working as a community organizer in East Tennessee. Living in Appalachia, I had become sensitive to what happened when communities did not control the land, since most of it was absentee-owned, with coal companies and timber companies controlling most of the landed resources. By the time I got to Cornell, therefore, I already had an interest in the connection between land tenure and community development. Or, as Appalachia demonstrated, the connection between the lack of local control over land and the lack of local development.

While I was in planning school, I had a HUD [Housing and Urban Development] internship, which allowed me to work at a housing services organization that was rehabilitating dilapidated housing and promoting homeownership in a lower-income, African American neighborhood on the edge of downtown. I watched this nonprofit organization transform a disinvested neighborhood. By every measure, this was a community development success – improving the quality of the buildings, lowering the crime rate, increasing private investment. But another part of this transformation was less successful, for we also helped to gentrify the neighborhood and to displace people who had lived in that neighborhood for a long time.

I tied that experience in an urban neighborhood to my work in rural Appalachia and said to myself there has to be a better way to do community development. I began looking for alternative models of land and housing tenure that might promote development without displacement. At Cornell, they organize the graduate school by fields, not by departments. I was in Development Sociology, a field that straddles the boundaries among sociology, planning, economic development, and political science. The chair of my doctoral committee was a professor named Chuck Geisler. He is a sociologist with a special interest in land use planning and community development. Chuck Geisler introduced me to Chuck Matthei, the former executive director of the Institute for Community Economics (ICE). That is how I was exposed to the community land trust as a possible solution to the problems of land tenure I was wrestling with. After I finished my doctoral work, I went to work for ICE. I was ICE’s field representative in Cincinnati and ended up writing my dissertation on the history and transformation of the African American neighborhood in the West End of Cincinnati. That became the basis for my first book, Contested Ground, which examined gentrification, disinvestment, reinvestment, and grassroots efforts to gain community control of land and housing in an African American neighborhood.

What do you see as the main benefits that community land trusts provide? What are the principal benefits in strong market cities? What benefits do community land trust provide in weak market cities?

For years people believed the principal benefit of CLTs was to preserve affordability in hot markets. The model had proven its effectiveness in locking public investment into affordable housing, commercial space, or office space in any area where public monies were being invested to create affordable housing or to create jobs. If you invest public money, the problem is how do you preserve the affordability of the housing you’ve subsidized; or how do you maintain affordable access to commercial space. The answer provided by the CLT is that you lock those subsidies in place. In a hot market, there are always pressures to remove affordability and to privatize the public’s investment. CLTs keep that from happening. They prevent the loss of affordability when real estate markets are hot.

Since the bust of the housing market in 2006, however, we have also discovered that community land trusts and other forms of shared equity homeownership are equally effective in cold markets. The principal benefits of the CLT in cold markets are to protect the condition, the quality, and the upkeep of the buildings on the leased land and to intervene in cases of mortgage delinquency to protect security of tenure and prevent foreclosure.

The shorthand phrase that we sometimes use in the community land trust movement is “countercyclical stewardship” – providing special protection during those turbulent times in the business cycle when homes and homeowners are at greatest risk. Most housing and community development programs in the United States have been designed as if there is no business cycle. What community land trusts are particularly good at is preventing the loss of homes, homeowners, and public investment at both the top and the bottom of the business cycle. We run counter to the threats and dangers that a fluctuating economy imposes on low- and moderate-income people.

A term that you have helped popularize to describe how land trusts work is “shared equity homeownership.” What is meant by the term and how does this form of housing affect the average homebuyer?

Shared equity homeownership was a term that was coined in 2006 as part of a research project sponsored by the National Housing Institute. This project was mounted to examine the prevalence and performance of various forms of resale-restricted, owner-occupied housing – the principal examples being community land trusts, deed-restricted houses and condos, and limited equity cooperatives. The advisory committee that NHI pulled together to oversee this project wanted a generic term that would describe these models and mechanisms of resale restricted owner- occupied housing as a single sector, where organizational and operational features that are common to all of these alternative forms of homeownership are more important than those features that distinguish one model from the other.

Our working definition has evolved somewhat since 2006, the year that NHI published the results of its research in a book-length manual entitled Shared Equity Homeownership. There is more of an emphasis today on how these models perform, especially in the period after a home is sold, as opposed to an earlier focus on how these models are structured. My own definition, recently put forward in an article published in the ABA Journal of Affordable Housing and Community Development Law, is that shared equity homeownership is “a generic term for various forms of resale-restricted, owner-occupied housing in which the rights, responsibilities, risks, and rewards of ownership are shared between an income-eligible household who buys the home for a below-market price and an organizational steward who protects the affordability, quality, and security of that home long after it is purchased.”

The sharing of equity, therefore, is more than merely sharing the backend proceeds on the resale of the home. You are also sharing many of the sticks in the bundle of rights. In a conventional market-rate home, a single owner holds all (or nearly all) of the rights, responsibilities, risks and rewards. In a shared equity home, we untie that bundle and reallocate those sticks between the individual homeowner and an organization that stays in that picture for many years. In the case of the community land trust, that organizational steward is a nonprofit corporation with a community membership and popularly elected board. Some of the responsibilities and many of the risks of homeownership are carried by the community land trust rather than by the homeowner alone.

In terms of dividing up the back-end proceeds, however, how does this work?

In every case, there is a ceiling as to how much equity a CLT homeowner can remove at resale. This allows the community land trust to re-purchase the home at a below-market price. The CLT then turns around and resells that same home for a price that another low-income or moderate- income family can afford. CLTs across the country use many different resale formulas to set that ceiling and to determine how much equity a homeowner will earn when moving out of her CLT home. At a minimum, under most formulas, the homeowner is going to get back her downpayment, the amortized portion of her mortgage, and a credit for any capital improvements she made after purchasing the home – plus a return on her original investment, which can be a little or a lot, depending on the formula.

In Burlington, Vermont, where I live, the Champlain Housing Trust uses a resale formula where homeowners get back their downpayment and whatever principal they have paid down on their mortgage. They receive a credit for any capital improvements they may have made and they earn 25 percent of any appreciation that has occurred in their home between the time of purchase and the time of resale. On average, after five-and-a-half years, a homeowner is going to resell a CHT home and walk away with an additional $12,000 to $15,000, beyond the downpayment she originally brought to the deal – at least that is what has happened in Burlington over the past 27 years.

If you look at buying a CHT home purely as an investment vehicle, we can say for sure that it is a better investment than putting your money in a savings account or even in the stock market. In Burlington, the 233 homeowners who have resold a CHT home have realized, on average, a 31% annualized IRR [internal rate of return], according to a recent study by the Urban Institute, entitled Balancing Affordability and Opportunity. That same study found an IRR of 39% at a CLT program in Duluth Minnesota and an IRR of 22% at a CLT program in Boulder, Colorado.

As a straight financial investment, therefore, buying a CLT home is a pretty good deal. It is not as good a deal, of course, as you could get if you have the wherewithal to buy a market-rate home without the restrictions – and you happen to be in a strong real estate market. A CLT home is a tenure option in between being a renter, where you get no return, and a market-rate home where you get all of the windfall that a rising market might award.

One of the roles you have played in the community land trust movement is that of an informal historian. For those not familiar with the origins of the CLT, can you highlight some of the key forces behind the movement’s emergence?

The roots of the movement are old and deep, even though the modern-day model is relatively new. The first community land trust in the United States, New Communities Inc., was created in 1969. The roots of the model go back much further, however. The way that community land trusts treat ownership, with one party owning the land and another party owning the structural improvements on the land, is an approach to land tenure that is rooted in the Garden Cities of England, the agricultural co-ops in Israel (kibbutzim, moshavim) that are located on land leased from the Jewish National Fund, and the Gramdan Movement in India. All are examples of planned residential and commercial communities on leased land.

The roots of the community land trust’s commitment to being an open membership organization, with a governing board on which many interests are represented, are to be found in the American civil rights movement. The leaders of the first community land trust all came out of the civil rights movement. Slater King, a first cousin of Martin Luther Kind, was president of the Albany Movement. He also became the first president of New Communities, Inc. When he was tragically killed in an automobile accident, the presidency of New Communities passed to Charles Sherrod. Rev. Sherrod had been a field organizer for SNCC [Student Nonviolent Coordinating Committee] and later founded the Southwest Georgia Project.

Another important piece of the history of the first CLT was the connection to Koinoina Farms, located just outside of Albany, Georgia. At the height of the civil rights movement, this community was an oasis of racial harmony, where you had whites and blacks running a cooperative farm that was under attack by the KKK. They had a hard time buying farm equipment or selling their agricultural products to local businesses. Slater King and Charles Sherrod were certainly aware and supportive of the work going on at Koinoina. Bob Swann, someone else involved in the creation of New Communities and a man who went on to become one of the founders of the community land trust movement, was the chair of Friends of Koinoina, a national organization that helped to raise money for the farm and to sell its pecans and other agricultural products. Swann was also on hand when Clarence Jordan and Millard Fuller began laying the foundation for Habitat for Humanity. Indeed, it is fair to point to Koinoina Farms as a seedbed for both the community land trust movement and Habitat for Humanity.

Can you talk about the impact of community land trusts on foreclosure rates?

The National Community Land Trust Network has been closely watching and measuring foreclosures over the last few years. The Network now has very solid research, documenting a delinquency rate and foreclosure rate among the owners of community land trust homes that is miniscule; indeed, the foreclosure rate among CLT homeowners is many times lower than the national foreclosure rate reported by the Mortgage Bankers Association for market-rate homes. In the Network’s latest survey, CLTs across the country reported a foreclosure rate of only .56% at the end of 2009. This compared to foreclosure rates reported by the MBA of 3.31% among homeowners holding prime mortgages and 15.58% among homeowners holding subprime mortgages. What makes the superior performance documented by the National CLT Network even more impressive is that CLTs are serving households who are much poorer than most of the mortgage holders in the MBA’s foreclosure study.

In Burlington, the community land trust here has boosted nearly 650 low-income households into homeownership over the past 27 years, while having only nine foreclosures. And the Champlain Housing Trust has never lost any lands or homes because of a foreclosure. Even in those nine cases where the land trust was unable to prevent foreclosure, CHT was able to protect the assets and to keep both the land and the homes in its portfolio. That’s a pattern of success repeated by CLTs throughout the country.

Why are community land trust foreclosure rates lower?

It begins before we ever sell the home. We do a lot of preparation and education with prospective homebuyers so that people only buy homes they can afford. The community land trust also imposes a screen on prospective mortgages to prevent predatory lending and to prevent people from entering into financial arrangements that put them in risk. Community land trusts also build three important rights into the mortgages on CLT homes. First, the community land trust wants to be notified if there is a mortgage delinquency. Second, the community land trust wants the right to step into a default situation and to cure the default on the homeowner’s behalf if the homeowner cannot do so herself. Third, if despite this intervention, the community land trust is unable to prevent foreclosure, the community land trust wants the first right to buy the home out of foreclosure, making the lender whole while preventing the loss of the land and the home from the CLT’s portfolio. Finally, most community land trusts, after they sell a home, maintain a continuing relationship with the homeowner. We don’t just sell a home, take the homeowner’s picture, shake the homeowner’s hand, and say good luck. In the worlds of Connie Chavez, executive director of the Sawmill Community Land Trust in Albuquerque, “we are the developer that doesn’t go away.”

Because the community land trust does not go away, while also maintaining a relationship with its homeowners and reserving a third of the seats on its governing board for people who live on its land, homeowners are more likely to notify the CLT when they get in trouble. They don’t hide it. They come to us, so we know if they are getting behind in their finances. Then too, CLTs charge a lease fee for the use of their land. Typically, the first thing a homeowner does who is in financial trouble is to stop paying the CLT’s lease fee. We have a built-in early warning system that tells us when a homeowner is in distress. That allows a CLT to work with homeowners before they get more deeply in debt, more seriously behind in their payments. That allows a CLT to intervene at an early stage to ensure that short-term trouble that doesn’t lead to foreclosure. Put all of that together and that’s why I believe CLTs have much lower foreclosure rates than are experienced by borrowers in the regular homeownership market.

You’ve been with Burlington Associates since 1993, during which time you and your partners have assisted more than 100 community land trusts nationwide. What trends have you seen in the CLT movement?

The first trend is steep growth. There were only a dozen or so community land trusts in the early 1980s; today, there are over 240. The proliferation of community land trusts is quite striking, along with their dispersion across the United States. We now have CLTs in 45 states and the District of Columbia. There are also community land trusts in Puerto Rico. So the first trend that I’ve seen is growth: more CLTs, scattered more widely across the landscape, along with an increasing number of CLTs with a substantial portfolio of lands and buildings under their stewardship.

Second, community land trusts are diversifying their lines of business. In the early days, most CLTs concentrated on housing, focusing on owner-occupied housing in particular. Now community land trusts are developing and stewarding many different types and tenures of housing – including limited equity cooperatives, condominiums, rental housing, mobile home parks, SROs, and homeless shelters. Also, some community land trusts are doing much more than housing – or doing no housing at all. There are CLTs that focus on urban agriculture, neighborhood parks, transit oriented development, jobcreation, office space, or service facilities for inner-city neighborhoods. They are also diversifying their strategic partnerships, working more closely than ever before with CDCs, churches, Neighbor-Works organizations, Habitat for Humanity affiliates, and both urban gardeners and rural conservationists.

A third trend is regionalization. Thirty years ago – even 20 years ago – almost all community land trusts worked in a single neighborhood or in a single small town. Today, we have community land trusts that span multiple neighborhoods, an entire city, or an entire county or metropolitan region. In a couple of smaller states, such as Delaware and Rhode Island, we have CLTs that span the entire state. We are seeing a trend, therefore, of CLTs that are carving out much larger service areas than occurred in the movement’s earlier years.

Another trend that we are seeing might be described as municipalization. There are an increasing number of community land trusts that were initiated by or supported by city or county governments. Twenty or thirty years ago, almost every CLT was created as a grassroots, bottom-up organization that emerged out of local struggles to promote development, to prevent gentrification, to prevent displacement, to empower a low-income neighborhood. There are still a number of community land trusts that get started like that today. But there are an increasing number of CLTs where the local government has helped to plan it, to create it. If you look at new community land trusts today, many have a municipal connection.

One trend that you have highlighted is the growing role of city governments in supporting the development of community land trusts? Why is there that interest and how are they working out?

City and county governments have become interested in community land trusts, first and foremost, because municipalities are putting ever-higher per-unit subsidies into helping lower-income people to become homeowners. Prudent public officials don’t want to see those subsidies lost in a time of fiscal scarcity. Whether a city’s politics tilt toward left or right, there is a desire to make sure that any public investment stays in a project and is not lost. The principal interest in CLTs on the part of cities and counties has come from a newfound concern for subsidy retention—a priority for locking the public’s investment in place.

Second, there is interest from municipal officials in making sure that affordable homes produced as a result of inclusionary zoning, incentive zoning, and similar programs are not lost. When government gives a developer a regulatory concession or requires the provision of affordable housing as a condition of zoning approval, cities want to see that those housing units remain affordable for longer than 5, 10, or 20 years. Community land trusts are an effective way to do that, whether the housing is rental or ownership.

Recently, a growing municipal interest in TOD [transit oriented development] has drawn a whole new set of public officials to the community land trust model. If you are truly interested in preserving a mix of uses and a mix of incomes in a redevelopment area surrounding a new transit stop, the only way to accomplish that is to have some sort of long-term controls on the land and the buildings. Otherwise, in a very short time, only the highest uses and highest incomes will come to dominate that area, displacing everything else. Community land trusts are a perfect complement to TOD – a vehicle for perpetuating a social equity commitment alongside a sizable public investment in light rail, smart growth, public parks, and other infrastructure.

Are the city-sponsored land trusts working? Do we have enough data yet to know?

We have a lot of information about CLTs in small and mid-sized cities. There, we have a track record of success and sustainability. Some of the efforts in larger cities are either too new or untested to say for sure. Chicago, Irvine (California), Atlanta, Sarasota (Florida)– are all examples of cities that are putting significant resources into creating community land trusts – it is just too early to say what their long-term success is going to be. The scale is so different. In Chicago, if you add 200 units of permanently affordable housing you have far less effect than in a smaller city like Duluth, Minnesota. So it is just hard to measure the impact and success as yet.

The most interesting case that is unfolding right now is in Atlanta, where the largest urban redevelopment project in the United States is underway. The Atlanta Beltline made a commitment from its early days to prevent displacement as part of this massive TOD [transit-oriented development]. The Beltline Partnership, under the leadership of a dynamic, socially conscious woman named Valarie Wilson, has played a starring role in supporting the development of a “central server,” the Atlanta Land Trust Collaborative, that will seed and support the development of a number of neighborhood-based community land trusts along the 22-mile light-rail corridor of the Beltline. The Collaborative and local CLTs are being put in place to ensure that low-income and moderate-income residents get to share in the benefits of the city’s investment in TOD and don’t suffer the burdens of displacement. It is too soon to say how it will pan out, but it is noteworthy and very impressive that people in Atlanta have planned for success. They have tried to anticipate the negative externalities and social inequities that often result from a massive public investment in “urban renewal.” They have built social equity into their planning from Day One.

Can you talk a bit about efforts in New Orleans to create local networks of inter-linked community land trusts?

There is a dual effort in New Orleans. In the Lower Ninth Ward, there is a focus on using a CLT to do housing, where an existing organization, the Neighborhood Empowerment Network Association (NENA), is sponsoring a land trust program. There is also a citywide effort, the Crescent City Community Land Trust, which was set up to support NENA but also to support community land trusts in neighborhoods across New Orleans. The Crescent City CLT has a focus not only on the production and preservation of affordable housing, but also on the redevelopment of commercial corridors and commercial districts in less affluent neighborhoods.

Can you describe the effort in Cleveland, Ohio to develop cooperatives on community land trust property?

We shouldn’t forget that there are two CLT efforts in Cleveland. The Community Land Trust of Greater Cleveland, formerly the Cuyahoga CLT, has been around for ten years, developing and stewarding resale-restricted, owner-occupied housing. A second CLT effort has arisen more recently in conjunction with comprehensive planning for redevelopment of Greater University Circle. In the latter case, the decision has been made to create a community land trust as a subsidiary corporation that is nested within the Evergreen Cooperative Corporation. The CLT is not going to be a freestanding, autonomous corporation.

I think this idea of nesting a community land trust within a cooperative structure holds potential for being replicated in other places. The three elements in Cleveland that I find most interesting and innovative are (1) the CLT’s integration into a cluster of cooperative enterprises, (2) the CLT’s connection to the Greater University Circle redevelopment planning, and (3) the CLT’s emphasis on job creation and workforce issues as its first priority. It may branch out into housing down the road, but the Evergreen CLT’s initial focus will be on assembling and holding land for enterprises that are cooperatively owned and managed, enterprises that create jobs for residents of a low-income neighborhood. I think that is going to push the boundaries of the CLT and provide new models and best practices that will be replicable and inspiring for community land trusts across the country. That’s a pretty amazing trio: a community land trust in a nested structure of cooperatives, tied explicitly to a very large urban redevelopment plan, focused on job creation. Those are leading-edge innovations that community land trusts around the country can learn from, so I am pretty excited about that.

There has been a growing movement in recent years for cities and counties to create land banks to publicly plan for the productive reuse of vacant land. How do community land trusts relate to these publicly owned entities?

There are some things that municipal land banks do very well: acquiring abandoned properties, contaminated land, and derelict buildings; clearing title; remediating toxins in the soil; demolishing derelict buildings; and getting those sites ready for redevelopment. What they do less well is maintaining accountability for residents of the local neighborhoods in which they are acquiring land; figuring out what should happen to the land after title has been cleared and problems have been mitigated; and preserving the affordability, condition, and security of housing and other buildings that are erected on remediated lands after they leave the land bank. These latter activities are what a CLT does especially well. There would seem to be the potential here for a partnership, where the public land bank acquires, holds, and improves land and then conveys that land to a community land trust, with the latter serving as the long-term steward of the land and any buildings that are constructed on the land.

Our record in the United States with urban renewal agencies, redevelopment authorities, and public land banks is not very good when it comes to the question of what happens to land after it leaves the land banks’ inventory. Most land banks are designed to hold land for no more than five years and to put that land back onto the market. In most land banks, that land is sold at the highest price; therefore much of that land is lost for affordable housing, community enterprises, and equitable development. To build both accountability and long-term stewardship into the system, a land bank is not enough.

What is happening in Atlanta is an evolving partnership between the City of Atlanta-Fulton County Land Bank and the Atlanta Land Trust Collaborative. I know in Cleveland there have been discussions of something similar being negotiated there for the Evergreen CLT, but I don’t think that conversation is as far along as it is in Atlanta.

How much subsidy is required to make community land trusts work on a sustainable basis?

You have to distinguish between outside support for stewardship and outside support for development. Community land trusts set a goal for themselves of building a portfolio of sufficient size to generate internally enough revenue to cover the cost of stewardship – that is, to pay for their staff and to cover their operating costs of overseeing the affordability, condition, security of the buildings on land trust land. Until a community land trust reaches the point of having built that sizable portfolio, they are entirely dependent on public and private subsidies to help pay their operating costs. Even when a larger community land trust with a 100-unit, 200-unit, or 300-unit portfolio is able to cover the cost of stewardship, however, it will never reach a point where it can build a surplus sufficient to develop its next project. CLTs will always be dependent on public equity and private contributions to bring land into their portfolios and to bring the price of housing down to a point where low and moderate-income people can afford. So there is the potential for sustainability and self-sufficiency on the stewardship side, but this is impossible on the development side.

There is nothing about the community land trust that makes it any less expensive for a CLT to assemble land and to develop affordable housing than for anyone else. Land costs what it costs and a two-by-four for construction costs what it costs. And low-income people are always going to be too poor to buy a home without a lot of help. That is the way the world works. If low- and moderate income people could become homeowners without public assistance, there would be no need for publicly funded homeownership assistance programs. At the start of the Great Depression the homeownership rate in the United States was 45 percent. Without the intervention of government our homeownership rate would still be 45 percent, instead of being close to 67 percent.

There is no such thing as “affordable” housing. There is only subsidized housing, where public dollars, public powers, or public tax expenditures have helped to bring an expensive commodity into the reach of people priced out of the marketplace. That’s true if you’re a middle-class person taking advantage of low-interest loans from a state housing finance agency and tax policy favoring homeowners or a lowincome household getting rental assistance. There is subsidized housing for three quarters of the population. It is just that some public subsidies are more obvious and politically vulnerable than others.

The largest public subsidy we have in the United States is the deductibility of mortgage interest. That is a $130 billion a year federal subsidy for homeowners, most of which is pocketed by the wealthiest homeowners, dwarfing the total amount of money that HUD [U.S. Department of Housing and Urban 10 Development] distributes every year for all other affordable housing and community development programs combined.

Are there specific ways that public policy could be changed—at either the local, state, or federal level — to better support community land trusts? What changes would you recommend?

A lot of the money that community land trusts have depended on for their growth comes from federal programs, such as CDBG [Community Development Block Grants], HOME [HOME Investment Partnerships Program], NSP [Neighborhood Stabilization Program], weatherization programs, and the secondary market – Fannie Mae and Freddie Mac. All of those programs are presently on the GOP’s chopping block.

What do community land trusts need? They need the public funding they have relied on to grow and survive. There is nothing magical about community land trusts. They need equity if they are to provide affordable housing and community facilities for persons too poor to do it for themselves. CLTs can get debt on the private market. But the equity comes primarily from the public sector. Once we bring land and homes into our portfolios, we don’t need as many additional subsidies down the road. But you have to get the property into the system in the first place. The big need is equity.

The second concern right now for community land trusts or for any affordable housing developer is affordable mortgages with underwriting criteria that don’t preclude you from serving the low- income homebuyers you are trying to serve. With the bursting of the housing bubble, lenders have tightened up on their underwriting and made it harder for our people to get loans – even though we have evidence that our homebuyers seldom default; and when they do, we are there to back them up and prevent foreclosure. Nevertheless CLTs are still looking at constrained lending through state housing finance agencies and bank consolidations. Many lenders who have lent to community land trusts in the past have merged with larger banks that don’t know as much about the model.

The third area we are going to have to tackle is local property taxes, so that taxes align with the resalerestricted value of the home. It is difficult to go into much detail here, because it is a problem that is such a patchwork quilt, differing state-by-state and city-by-city.

A fourth problem area for us is FHA [Federal Housing Administration]. The community land trust movement has been negotiating with FHA through five presidential administrations, trying to get some changes to FHA rules to make it easier for lenders to use FHA insurance and products for financing resale-restricted CLT homes. We’re still trying to get these changes, although I think we’re close to cracking the nut at long last. I think this administration is finally going to change the FHA program to make it easier to get FHA loans for resale-restricted homes, removing a major barrier that has been plaguing CLTs for many years.

Can you talk about the role played the National Community Land Trust Network in expanding the movement?

Well, the National Community Land Trust Network functions as something of a trade association for CLTs in the United States. It is a membership organization that is governed by the CLTs themselves. It is designed to provide advocacy and support, technical assistance, and training for its members. The 11 Network has taken the lead in negotiating with HUD and FHA, seeking to amend the latter’s rules. The Network has also helped to build the CLT movement by forging strategic alliances with other national intermediaries like NeighborWorks America, Habitat for Humanity International, and the Cornerstone Partnership.

One of the Network’s oldest and largest programs is the CLT Academy. The Academy is a chartered program under the Network’s umbrella with a semi-autonomous status and its own board. The Academy is the Network’s training and research arm. It has two departments – one that focuses on developing courses, seminars, trainings, and webinars to raise the standard of practice throughout the field and another department that focuses on research and publications. The latter department oversees the annual foreclosure study and has recently produced a new technical manual and model ground lease. It is also involved in collecting best practices, evaluating what works well and what doesn’t work so well in the world of CLTs. Those “best practices” are then thrown over the fence to the curriculum department, eventually becoming the content for future trainings.

What do you see as the most important challenges or opportunities facing community land trusts today as the movement expands and becomes more diverse?

A strength of the CLT model is its versatility in the ways that CLTs are structured, operated, and applied. But a model that plastic and that malleable runs the risk of becoming all things to all people. There is a temptation to lop off key elements of the model that you find politically messy. There is a risk of diluting the model’s core values to the point where it may no longer be fair to call it a community land trust at all. There is strength in versatility, but there is always the risk of dilution: you modify or remove so many essential features and values that the pieces no longer fit together to achieve the social justice and economic development aims that you set out to achieve.

There has always been a tension in the evolution of this model. You don’t want to be so purist that you don’t allow flexibility and variation. At the same time, you don’t want to be so lax, so laissez faire as to call anything a community land trust just because it happens to contain a tiny piece or two of the whole package. It’s not uncommon these days to find people who come from the worlds of government or banking or business who say, “I really like land leasing, subsidy retention, and permanent affordability, but these democratic elements that come with the CLT are a little too messy.” What they are saying, of course, is that democracy slows things down. Democracy gets in the way. Why don’t you remove the “C” from community land trust?

But in this movement we believe there are practical, moral, and political reasons for the way in which the “classic” CLT is structured. You can modify that structure. You can tailor it to fit local conditions, priorities, and needs. But you can’t simply lop off essential organizational, ownership, or operational elements without doing serious damage to the model itself.

What do see as the highest priorities for the moving going forward in the next 5-10 years? What do you hope to see?

I would like to see an increase in the number of community land trusts. I would like to see an increase in the scale of individual community land trusts. And I would like to see more progress made toward ensuring the sustainability of the organizations we have created. Any goals for the CLT movement would have to include these three: number, scale, sustainability.

That is an aspirational goal not only for CLTs in the United States but for CLTs in other countries as well. There are vigorous CLT movements currently underway in Australia and England. There are CLTs being started in Belgium and Canada. I have been invited to all of these countries in the last few years, conferring with very smart CLT organizers who are applying the model and modifying the model in wonderful ways. The CLT movement in the US may soon be learning as much from them as they are learning from us.

Another hope that I have for the CLT movement here in the US is that we will continue to pay particular attention to racial diversity, making sure that communities of color are included in everything we do. In the governance of the movement, in the trainings that we do, in the priority we give to allocating the Network’s resources, we must ensure that communities of color are not bypassed. Both the Academy and the Network are presently giving special attention to the application of community land trusts to what we refer to as Heritage Lands – land-based assets in communities of color where the future of that community in that place depends on who controls the land. If low-income and moderate-income people of color are removed from increasingly valuable land then, as a movement, we will have missed the opportunity to deliver this powerful tool to communities who are most at risk. We will have missed the chance to help people of color to, “take a stand and own the land,” in the words of the Dudley Street Neighborhood Initiative in Roxbury, Massachusetts.

When you have college towns, suburban communities, and resort communities increasingly interested in community land trusts, there is a temptation to shift resources in their direction. These are places where it is somewhat easier doing development, places where you have the backing of the powers-thatbe. Doing workforce housing for hospital workers or inclusionary housing for cops and firefighters in an affluent community are perfect examples. There is nothing wrong with that; indeed, community land trusts are having great success in opening up affluent enclaves to people who could not otherwise live there. But, at the same time, we cannot overlook people and places that need a community land trust as a bulwark against the powers-that-be, a bulwark against economic forces that tend to displace low-income people, especially low-income people of color, whenever real estate markets get very hot – or very cold. We are trying to make sure these communities are not neglected.

The CLT emerged out of the civil rights movement. If we are to remain true to our roots and values, we must continue to give priority to people who are outside of the political and economic mainstream. We must continue to embrace what the liberation theology of an earlier day referred to as “a preferential option for the poor.” That commitment has to be intentional. It has to be directed. It has to be conscious. It is the moral ground on which CLTs must stand – and from which CLTs must continue to draw their purpose and vitality – in good times and bad.

For more information on community land trusts, see: www.cltnetwork.org and www.burlingtonassociates.com.